What’s next for gold?

Gold surged to an all-time high this week, boosted by expectations for US rate cuts, geopolitical tensions, and China’s economic woes. How much further can it go?

All eyes on the Fed

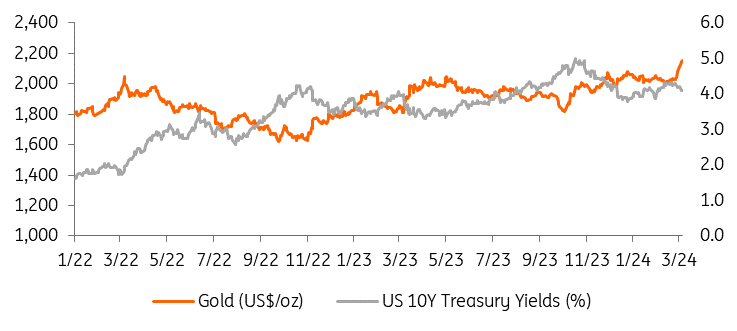

The key driver for the outlook of gold prices for the past year has been the Federal Reserve policy. Our US economist expects the first cut in June while swaps markets show a 65% chance of a cut in June compared with 58% at the end of February.

Gold rose to a peak of $2,164.78/oz on Thursday before paring some of the gains. However, this week’s move higher was not driven by any significant change in the outlook for when the Fed would start cutting rates.

Fed Chair Jerome Powell reiterated this week that it will likely be appropriate to begin to lower borrowing costs “at some point this year”, but also said that the central bank wants more confidence that inflation is moving sustainably toward 2%. Lower rates are typically positive for gold, which doesn’t offer any interest.

Treasury yields are on the way down

Still, the fundamentals look supportive for gold. Gold prices have held above the key $2,000/oz level since December, with the precious metal being supported by safe-haven demand amid geopolitical tensions. Ongoing geopolitical risk in Ukraine and the Middle East continue to provide support to gold.

Investors turn bullish on gold

As well, investors’ interest in the precious metal finally returned, with the latest Comex data showing money managers adding fresh long positions, reflecting bullish sentiment in the gold market.

Looking further ahead, we believe we will see more long positions being added given higher gold prices as US interest rates fall.

Investors return to gold

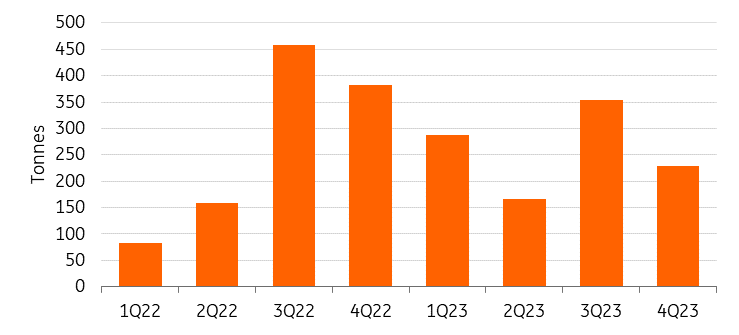

China leads central banks’ gold buying spree

Gold has also been supported by strong central bank buying, particularly by China. Central banks bought 1,037 tonnes of gold last year, just shy of the all-time high of 2022, as shown by data from the World Gold Council, as reserve diversification and geopolitical concerns pushed central banks to increase their allocation towards safe assets.

Last month, China’s central bank added gold to its reserves for a 16th straight month. The People’s Bank of China now owns 72.58 million troy ounces, equivalent to about 2,257 tonnes, after adding about 390,000 troy ounces last month.

In the Chinese domestic market, buyers have also flocked to gold amid the country’s economic woes. Swiss exports to China, which is usually a good indication of Chinese demand for the precious metal, more than doubled in January from December to 77.8 tonnes, while shipments to Hong Kong rose almost sevenfold to 44.6 tonnes, data from the Swiss Federal Administration shows.

Gold tends to become more attractive in times of instability when investors pile into safe-haven assets as a hedge against the economic climate, geopolitical tensions or inflation. We believe this is likely to continue this year.

Central banks keep buying gold

However, investment demand for gold is yet to rebound. Total holdings in bullion-backed ETFs have continued to decline. Global gold ETFs collectively saw another outflow in February, extending their losing streak to nine months. North America led outflows, while Asia was the only region that captured inflows, as shown by data from the World Gold Council.

ETF outflows continue

Gold eyes more gains

We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with the ongoing wars and the upcoming US election. We have revised our 2024 gold forecast higher, and we now expect fourth quarter prices to average $2,150/oz and we expect an average of $2,084/oz in 2024 on the assumption that the Fed starts cutting rates in June and the dollar weakens. Downside risks revolve around US monetary policy and dollar strength. The higher-for-longer narrative could see a stronger dollar for longer and weaker gold prices.

We expect gold prices to remain volatile in the coming months as the market reacts to macro drivers, tracking geopolitical events and Fed rate policy.

ING forecast